Last updated on July 23rd, 2013 at 06:56 am

2013 will surely be a year of firsts for Jeffsetter. While many of my blogger idols talk about credit card applications and reconsideration requests as everyday occurrences, some of these terms and actions are things that I have yet to experience.

During my Q1 Credit Card application signup bonus bonanza, I was immediately approved for just one of the three cards I was hoping to sign up for, the American Express Gold card with a 75,000 point signup bonus after $10k in spend.

The application for my second card, the Chase Ink Plus, was initially not going to be approved due to the amount of open credit I had with Chase. After a courtesy call from the Chase team and some quick explaining, this card was approved and sent to me as planned.

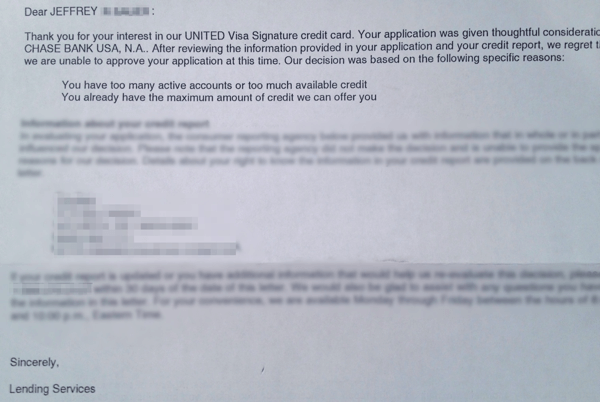

The third card, the United Explorer Card from Chase took so long to get a response that I wrote my original blog post without even knowing the status of this card application. In fact, it took a full 3 weeks after applying to get any kind of notice about the card at all. Because of the delay, I was fully expecting that the application would be denied… and that’s exactly what happened when I received the following letter in the mail from Chase:

My Chase United Explorer Visa Reconsideration Request

This is not entirely surprising to me, since I do have a lot of cards with Chase and they did give me a ton of credit on some of the cards. In fact, there was one particular card that they granted me last year that had a filthy amount of credit (think ~$50k on a personal credit card). In reality, I didn’t need that much credit, so I decided to give Chase a call to see if I could shift credit around to be approved for the United Explorer Visa. You can do the same in these easy steps:

1) Read Your Notice Carefully

Does the reason given in the letter provide you an opportunity to be reconsidered? If you are denied because of too much credit already or too many open accounts, these are both items that you can easily resolve over the phone (by either releasing credit or closing accounts). If it is for other reasons like credit defaults or other penalties on your credit report, you may have more trouble.

2) Call the Chase Reconsideration Hotline

The number I called was:

1-888-270-2127

You may have a different number in your letter. Make sure that you do this within 30 days of receiving the letter or you they may have to pull your credit again.

3) Explain Your Situation

My situation was easy. After years of Stockholm syndrome with the local carrier in Minnesota (first Northwest and now Delta), I am hoping to diversify my mileage balance and flying opportunities with United Airlines. Without airline status, the next best thing you can do to get some recognition from an airline branded credit card. The United Explorer Visa allows me to get some perks flying United and also beefs up my mileage bonus.

The other thing I explained is that I didn’t need the ridiculous amount of credit they gave me on my hotel branded credit card and said I would gladly take away from that credit allotment to fund this card. That’s exactly what we did. We took my credit down on the Hyatt card from the mean household income of a family in the United States to $5,000. Maybe that prevents me from buying a pontoon boat on credit, but overall I think I am fine with less credit on that card.

It was really that easy. I didn’t need to close any accounts in order to get approved. I just needed to shift my credit limit. Even better, I reduced the amount of credit they were allowing me by around $20k, which hopefully means I’ll have a lot less trouble getting instantly approved for chase cards in the future.

4) Enjoy the Benefits of your Chase United Explorer Visa!

The day after my approval on the phone, I received this email:

Now I am ready to start flying the skies with a new carrier (United) on a new alliance (Star Alliance). Maybe I will see you in a Thai airways lounge or on an Air New Zealand flight in the near future?

Have you ever gone through a reconsideration request? Was it as painless for you as it was for me?

I’ve had similar problems with Chase cards. I’ve yet to be denied from any other card that I’ve applied to (granted I’ve only applied/got accepted to ~5 in the past 6 months) but for some reason Chase continues to deny my application!! I’ve gotten different reasons why previous attempts have been declined and I’ve taken measures to remedy them. Recently, I applied again and was really hoping/expecting to be approved.. but again was told my application needed ‘further consideration’. I honestly can’t imagine what their reasoning is this time, but I feel more confident pleading my case for reconsideration after this post. Thanks and I’ll keep you updated!!

This past March I applied for the Ink Bold (because I needed the 50k miles to go to a wedding). I knew when I applied that I’d need to call the reconsideration line in a day or so, because I have a large debt-balance (following my husband’s death in 2011); and I have consolidated that balance onto three cards: two with zero-percent interest, one with 1.9%. (*Obviously* I was not going to leave any balance on the 19% card, or even the 12% card. I have ten cards.) That, to me, is careful financial stewardship; apparently to the banks/credit bureaus — it’s a sure sign I’m a scammer! (Yes, those three cards are above 65% utilization… But with $110k limit across all cards, and “just” {eye roll} $40k in debt — my overall usage is (or should be) acceptable. (Plus I already had a 2-yr-old Chase Slate with a 3.7k limit.)

I spent about 20 minutes on the reconsideration line; I had to explain the biz (a small manufacturing biz) and give the (nice) fellow sales-to-date, purchases-to date, and both for the previous two years; and I explained I had run $40k through on my “Kroger-linked” card, so it made sense to get an actual biz card; and here was my reasoning for consolidating onto three cards, and so on. Took him about 10 minutes to decide, but he did approve the card.

Painless? Yeah, pretty much. I had gathered up beforehand a lot of the financial info I thought he might need. (He did have to wait while I totaled up by hand the 2011 monthly sales.) I had my three scores (716, 735, 740) in hand. I knew what I’d spent on the Kroger card the year before. And, I had an explanation for why I was so far in debt (which I had paid down, in two years, from $52k to $40k). (My longest card goes back to 1997; nearly all were more than five yrs old.)

So, by having all the info you might need — and reading through ALL the blogs posts you can find about how to handle recons — even someone who might expect to be denied can do it.