Last updated on June 27th, 2024 at 10:29 pm

Gather around, everyone! Thanks to a recent proxy statement filed by Hawaiian Airlines, we now know the Alaska-Hawaiian merger backstory. And, oh boy! I wasn’t expecting things to go the way they apparently did. It also sheds light on the why, which is along the lines of what I was originally thinking.

Alaska-Hawaiian Merger Backstory

To get started on the Alaska-Hawaiian merger backstory, I want to go over how the discussion began.

- 8/2/23: Ben Minicucci contacts Peter Ingram to request a meeting. The two agree to meet on 8/9/23.

- 8/9/23: the two acknowledge the recent tragedy on Maui and expressed a mutual interest to help. They then jumped into the meeting where Minicucci made their initial offer to Ingram of $20 per share. Ingram stated that he’d present the offer to Hawaiian’s Board. On that day, HA was trading at $10.62.

- 8/14/23: Ingram shared the initial offer with the Board and Hawaiian’s legal counsel. From here on out, there were several internal meetings at Hawaiian with their counsel, and with third-party consultants.

- 9/4/23: Ingram contacted Minicucci to inform him that they’d like a revised proposal with an offer in the $20s per share range. Minicucci responded by asking for diligence information.

- 9/11/23: both airlines enter into a confidentiality agreement

- 9/15/23: members of both airlines’ management teams meet for the first time to discuss Hawaiian and its business, including its long-term plan. These types of meetings would recur over the coming weeks.

- 10/25/23: Ingram and Minicucci met again. At this time, Alaska lowered their offer to $17 per share. The reasons for the lower offer include: “(1) the higher capital expenditures contemplated by the September 2023 Long-Term Plan than those assumed by Alaska for the Initial Proposal; and (2) the lower profitability estimates for Hawaiian during 2024 and 2025 contemplated by the September 2023 Long-Term Plan as compared to Alaska’s assumptions underlying the Initial Proposal.” On that day, HA was trading at $4.13.

- 10/26/23: Hawaiian’s internal teams and consultants meet to discuss the state of the airline, including: (1) the devasting wildfires in Lahaina, Maui on August 8, 2023, which had significantly impacted travel demand to Maui in particular and Hawai‘i more generally; and (2) anticipated accelerated removals and inspections of a significant portion of the PW1100G-JM engines, which power Hawaiian’s A321neo aircraft. HA was trading at $4.10 on that day.

- 10/30/23: Ingram informs Minicucci that they’ll submit a counter-proposal on 11/6/23.

- 11/6/23: Ingram presents Hawaiian’s counterproposal to Minicucci for an acquisition of Hawaiian by Alaska at $18.50 per share in cash with a $100 million reverse termination fee – up from $75 million.

- 11/723: Minicucci informed Ingram that Alaska would acquire Hawaiian for $17.50 per share in cash with a $100 million reverse termination fee. In response, Ingram said that he did not wish to bring a proposal to the Hawaiian Board that contemplated an acquisition below $18.00 per share. Mr. Minicucci responded that he was willing to increase the per share value of Alaska’s proposal to $18.00 with a $100 million reverse termination fee, but only if the two parties aligned on these terms that day. The two sides would eventually come to an agreement on this day and HA was trading at $4.29. Over the next several weeks, additional internal meetings, along with those with Alaska continued to occur.

- 12/2/23: Hawaiian’s Board formally accepts the proposal and recommends shareholders vote in favor of it. Factors influencing their decision include: (1) the limited universe of potential buyers of our company; (2) competition law considerations for each such buyer; and (3) the larger regulatory landscape in the airline industry. Additionally:

- Our competitive positioning and prospects as an independent company. Included among these risks were consideration of (1) our size, as well as its financial resources, relative to those of its competitors; (2) new and evolving competitive threats; (3) challenges to increasing demand for air travel to Hawai‘i; and (4) other factors affecting the revenues, operating costs and profitability of companies in Hawaiian’s industry generally and other risk factors described in our other filings with the SEC, as listed in the section of this proxy statement captioned “Where You Can Find More Information.”

- Our history of losses, and the challenges to achieving profitability in the near term

- Our upcoming need to repay or refinance approximately $1.5 billion of long-term debt, as well as capital expenditures required in connection with, among other things, our planned acquisition of Boeing 787 aircraft.

- The continued softness in demand for air travel to Hawai‘i from Japan, which has historically been one of our key international markets. The Hawaiian Board was aware that this demand had not yet recovered to levels experienced prior to the COVID-19 pandemic, and that it was uncertain when, if ever, such demand would fully recover.

- The highly competitive nature of travel to Hawai‘i and among the Hawaiian Islands, including the impact of pricing decisions made by our competitors. In this regard, the Hawaiian Board was aware that larger airlines may have competitive advantages in relation to us from their broader commercial scope and economies of scale in pricing.

- Recent market volatility and the current and prospective business environment in which Hawaiian operates, including evolving macroeconomic headwinds facing Hawaiian and its industry more generally and the impact of changed economic circumstances on key customer segments, and the likely effect of these factors on us and the execution of our plans as an independent public company.

- The challenges of making investments to achieve long-term growth for a publicly traded company, which is subject to scrutiny based on its quarterly performance. The Hawaiian Board was aware that the price of our common stock could be negatively impacted if Hawaiian failed to meet investor expectations, including if Hawaiian failed to meet its growth or profitability objectives.

- The historical market prices, volatility and trading information with respect to shares of our common stock.

That’s a wall of text, but even this is a bit of a curated version of the Alaska-Hawaiian merger backstory. However, it does give us fantastic insights into how things unfolded. Of course, if you’ve been following Hawaiian’s financial performance, it comes as no surprise that this was a major factor in pushing Hawaiian’s Board to its decision.

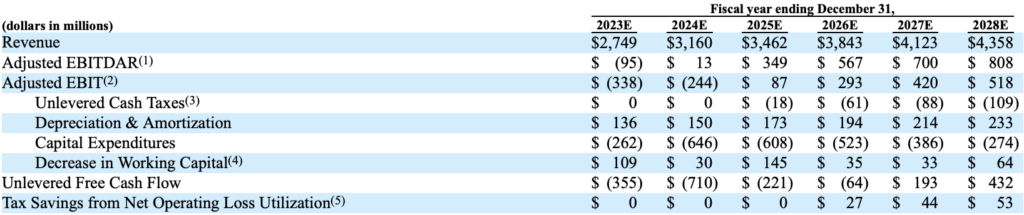

I do find it kind of funny that Hawaiian tried to get a higher acquisition price, but Alaska (rightfully) came back with an even lower offer. Even then, I fear Alaska may be overpaying for Hawaiian. I mean, just look at Hawaiian’s projections over the next five years. They’re not expecting to be cashflow positive until 2027. Mind you, these are projections made by Hawaiian’s management team – not investors.

What’s Next?

The whole reason why we got to dig into the Alaska-Hawaiian merger backstory, is because all these details were released as part of a required proxy statement for the upcoming shareholder vote. That vote, by the way, is occurring on February 16. I’d imagine that most shareholders will vote yes – why wouldn’t they?! They’re getting far more value for their shares than they would’ve otherwise.

Sure, Hawaiian’s stock has traded for much more in the past, but their current operating environment is like nothing the airline has ever seen before. In fact, their stock price peaked in the years after both Aloha Airlines and go! left the market. But the one-two punch of Southwest entering the Hawaii market and COVID-19, plus the PW1100G issue, Maui wildfire, and unfavorable Japanese exchange rate, all have significantly compromised Hawaiian’s financial position.

Yes, Hawaiian might be able recover, but it won’t be as profitable as it had been before, especially with all of the capital expenditures it has looming – 787s and a 717 replacement. Plus, Southwest continues to pressure Hawaiian like no other competitor ever has before, competing on routes Hawaiian has traditionally enjoyed a monopoly on.

Of course, if Hawaiian doesn’t find a way to recover, then the alternative is bankruptcy and a possible acquisition that way. Hawaiian’s Board saw the writing on the wall, and this was their best option (in terms of shareholder value). The risk of bankruptcy is, admittedly, quite high today and over the next few years. Mind you, Hawaiian only has $1.13 billion in unrestricted cash left as of the end of Q3 2023, and they’re projecting a $710 million loss this year. Yeesh.

Stipulations

Aside from the how and why, we also learn about important stipulations from the Alaska-Hawaiian merger backstory. For example, should Alaska decide to back out of the deal, they’d now owe Hawaiian $100 million. However, if Hawaiian were to back out of the deal, they’d be on the hook for $35 million. The Alaska-Hawaiian merger backstory also estimates a closing date around December 31, 2024, and provides an absolute deadline of June 2025. Extensions are allowed through December 2025, but only under certain government-caused circumstances.

According to the Alaska-Hawaiian merger backstory, Alaska would owe its termination fee for reasons including the Department of Justice ruling that the merger constitutes an antitrust violation. Whereas, Hawaiian would be on the hook if it accepted a different offer or shareholders rejected the offer.

Golden Parachute

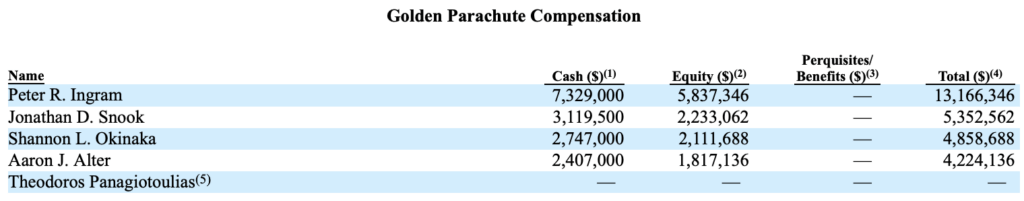

Whether or not Hawaian’s current executive team remains with the airline in some sort of capacity after the merger remains to be seen. However, the Alaska-Hawaiian merger backstory is preparing for the fact that they may not remain. In fact, there’s a whole section about Golden Parachute compensation.

Interestingly, the compensation is valid for “qualifying terminations” that occur three months before and up to 18 months after the merger closing. Equity compensation is based on a share price of $18 per share, which is what Alaska is paying to Hawaiian shareholders.

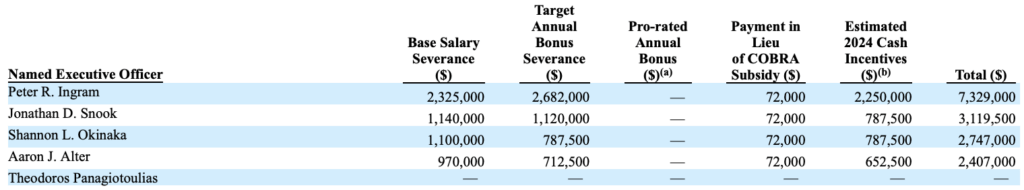

As you can see, many of Hawaiian’s top executives are set to receive a hefty payout if Alaska decides to not retain them. Drilling a little deeper, the cash portion of the compensation is determined by their current pay.

What I find interesting, though, is only four executives are listed in these compensation discussions, where as the company’s website lists 19. Does that mean the rest are getting nothing at all? Or that Alaska intends on keeping them aboard? Some of those excluded from the Golden Parachute discussion include Chief Marketing Officer Avi Mannis and Chief Operating Officer Brent Overbeek.

Alaska-Hawaiian Merger Backstory, Final Thoughts

There’s a lot that still has to happen before the merger finalizes. That said, the Alaska-Hawaiian merger backstory gives us an excellent view of what happened prior to the public announcement, and to me, it’s fascinating. Ultimately, though, it confirms my (and many others’ theories) that Hawaiian had concerns about its ability to remain solvent, and that this really is the best option available to them.

I’m not a shareholder, nor do I have any skin in this game (aside from my small HawaiianMiles stash), but I do agree that this is the best option for Hawaiian, too. American, Delta, United, and Southwest won’t be able to purchase Hawaiian, while U.S. law prohibits foreign ownership. So aside from a giant private equity firm buying them out, Alaska is the only option. I mean, JetBlue could attempt to do so, too, but they’re still trying to buy Spirit they gotta figure out what they’re doing with Spirit.