HawaiianMiles aren’t my favorite reward currency, but with the prospect of them turning into Alaska Mileage Plan miles, stockpiling them now isn’t a bad idea. So if you’re able to, you should take the opportunity to earn 70k HawaiianMiles now to be able to put them to better use in the future.

As we’ve seen with my comparison of Alaska Mileage Plan and HawaiianMiles, Mileage Plan miles are clearly the better reward currency. You earn both at about the same rate, but Mileage Plan has better redemption prices and far more partner options. Sure, things have gotten worse in recent years, but Mileage Plan still maintains its edge. However, what Mileage Plan lacks is a transfer partner, so building miles isn’t as easy as some other programs, such as HawaiianMiles. So when a chance comes around to bulk up on miles of either program, it’s worth considering taking it.

Earn 70k HawaiianMiles

The Hawaiian Airlines World Elite Mastercard isn’t my favorite card, though it does have its uses, especially if you’re a semi-frequent flyer with Hawaiian Airlines. After all, the card provides the following benefits:

- 3x miles on Hawaiian Air purchases

- 2x miles on gas, dining, and grocery stores (excluding Target and Walmart)

- 1x miles on all other purchases

- 2 free checked bags on all domestic flights

- A one-time 50% companion discount

- $100 annual companion discount

- discount award redemption options

- share miles with friends and families with no fee

Of course, the Hawaiian Airlines World Elite Mastercard typically comes with a 60,000-mile sign-up bonus. But for a limited time, you can earn 70k HawaiianMiles when you sign-up for the account and spend $2,000 in the first 90 days from account opening. Yes, a $99 annual fee does apply from the first year, but you can quickly earn that back, especially if you travel with someone.

You see, discounts aside, the card save you up to $85 per flight when flying between Hawaii and the continental U.S. – $40 for your first checked bag and $45 for the second. For inter-island flights, it’d save you up to $35 per flight – $15 for the first and $20 for the second. So just on baggage fees, the card can very quickly save you more than its annual fee if you travel with Hawaiian often enough.

But that’s not what this post is about – it’s about being able to get a chunk of HawaiianMiles that could potentially turn into Mileage Plan Miles. But is it worth, considering that the Alaska-Hawaiian merger hasn’t been approved yet? Probably.

How Risky is Stocking Up On HawaiianMiles

There’s no doubt that it’s great that you can easily earn 70k HawaiianMiles, but if you’re not a Hawaiian loyalist, how risky is it to stock up on their miles? Well, the largest elephant in the room is the aforementioned merger. But as I wrote the other day, I’m still confident that the transaction will close. Of course, that doesn’t mean there’s no risk involved with bettering for the merger. So, whether you want to take that risk or not is entirely up to you.

However, beyond the DOJ’s decision, there are internal risks to consider before you try to earn 70k HawaiianMiles. For example, should the merger close, we have no idea what the timeline looks like to get the two loyalty programs combined. Moreover, we don’t know when Alaska or Hawaiian will devalue their respective programs or the combined program again. We know it will happen again – that’s the one thing you can count on 100% in this crazy game of ours – we just don’t know when.

Alternatives… If You Can Afford It

There’s no doubt that the ability to earn 70k HawaiianMiles for just $2k in initial spend is great! However, if you have deeper pockets and have the ability to manufacture a much higher amount of spend, there are ways to earn eve more bonus points. Of course, the other way I’m referring to is via American Express. Specifically, the Gold and Platinum cards currently have increased signup bonuses, too, at 90,000 points and 125,000 points, respectively.

Of course, with those bigger signup bonuses also comes larger minimum spending requirements and annual fees. In this case, the Amex Gold has a minimum spending requirement of $6k in the first 6 months from account opening and carries a $250 annual fee. The Amex Platinum has an $8k minimum in the same six-month timeframe as the Gold, and has a $695 annual fee. Sure, both cards offer statement credits to buy down the annual fees, but I hate how Amex doles them out incrementally, such as $10/month on the Gold. It makes the credit far less worthwhile than the Sapphire Reserve’s $300 general travel credit.

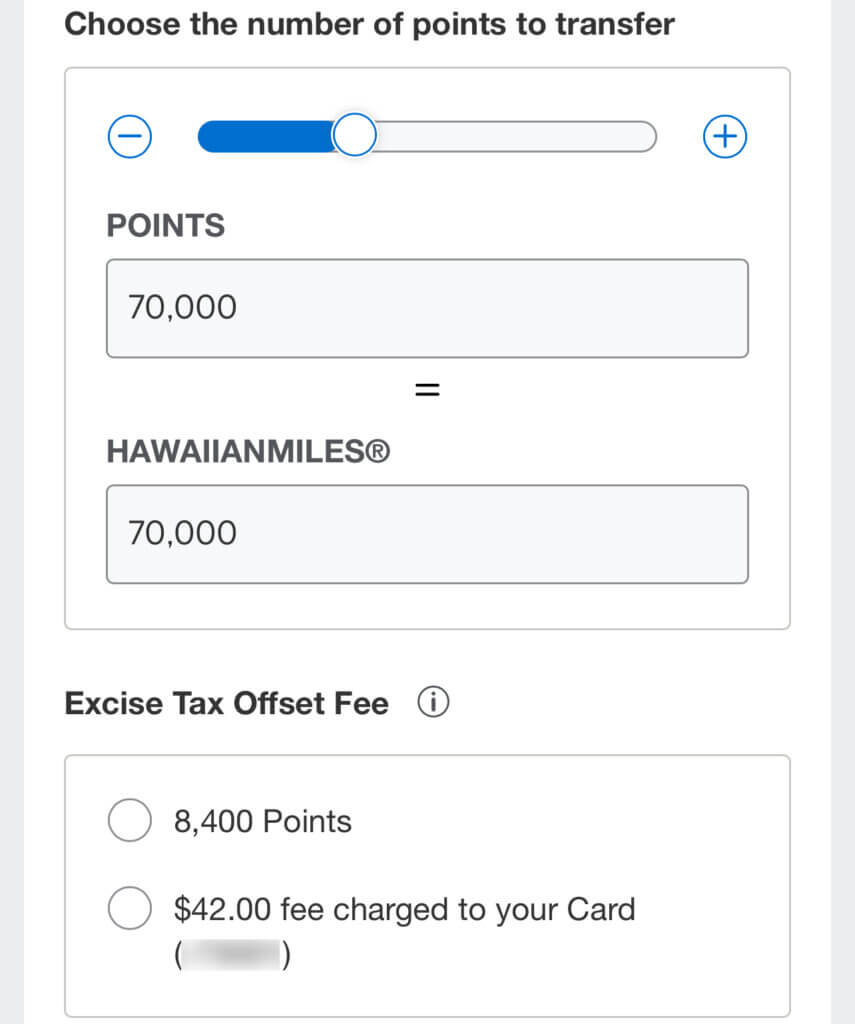

The other consideration to make when deciding if you want to go with Amex rather than the option to earn 70k HawaiianMiles with Barclays is points transfers. Yes, transferrable points such as Amex Membership Rewards are safer to hold in the long term than HawaiianMiles. However, unlike most other programs, American Express does charge you for transferring your points. The amount isn’t huge – for example, it costs $42 in excise fees to transfer 70k Membership Rewards points to HawaiianMiles – but it’s still good to know.

Of course, on the upside, the Amex Gold has killer earning power on everyday spend categories. For example, it earns 4x at dine-in restaurants around the world and 4x points on U.S. grocery store purchases up to $25,000 per year. That’s a lot of HawaiianMiles for spending on things you were going to in the first place.

Earn 70k HawaiianMiles, Final Thoughts

There are many options for you to stock up on HawaiianMiles right now, including the offer to earn 70k HawaiianMiles with just $2k in spending. However, whether any of these offers are worth it to you are not greatly depends on your risk tolerance. Personally, if I could qualify for the bonus and had the capacity to take advantage of the signup bonus, I’d probably go for the Amex Gold offer. But the Hawaiian Airlines World Elite Mastercard offer is great, too!