Last updated on April 5th, 2013 at 01:33 pm

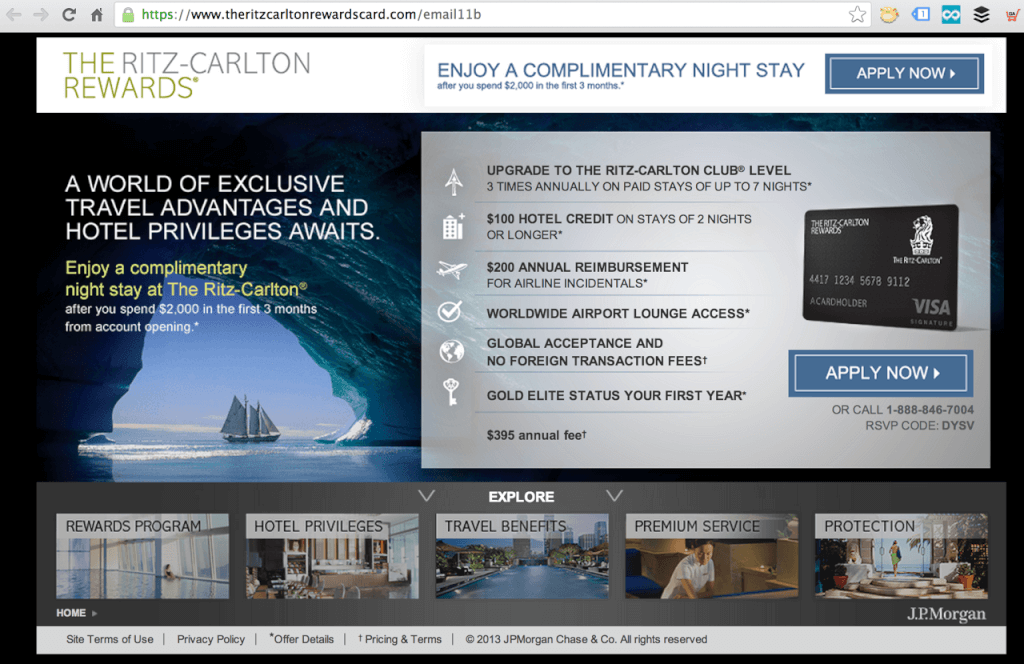

Ritz Carlton Awards members can take advantage of “exclusive” travel rewards by signing up for their branded credit card. All you need to do is spend $2,000 in your first 3 months to receive a free night at any of their properties. This alone can be a good deal, but they are also offering a $200 annual reimbursement in Airline incidentals and a complimentary airport lounge membership.

But how much does the Ritz Carlton Credit Card Cost?

“I’ll never tell” says Ritz Carlton in their email, but the club access alone is worth around $400 with comparable credit cards. Sure enough, when you read the fine print on the Ritz Carlton Card, their annual fee is $395, so this is all starting to make sense.

What else can you get for the Ritz Carlton Credit Card?

I thought you’d never ask. You can actually get quite a few perks by signing up for the card. While the rewards chart looks a bit like it was pieced together by Dr. Frankenstein, there are several desirable benefits to the card:

- Club level upgrades 3x a year

- $100 hotel credit of stays of 2 nights or more (this appears to be a huge value, but I haven’t read the fine print)

- The aforementioned $200 airline incidentals rebate

- Lounge access

- Gold status for Ritz Carlton in year #1

- No foreign transaction fees

Is the Ritz Carlton Rewards Card a good deal?

Honestly, on perks alone it is better than just about any card out there. That said, it also puts you in the hole ~$400 before you reap a single benefit. It also commits you to trying to stay at Ritz Carlton properties more often in order to take advantage of these other benefits. I write this as I sit at a Hilton property in plain view of a Ritz Carlton. Maybe I would have chosen to put on the Ritz if I had this card?

It all comes down to the following: Will you actually use this card to its fullest? Will you change your behavior to stay at Ritz Carlton or will things stay the same? If you aren’t going to change the way you go about business, then don’t use the card. In addition, avoid the card if you already have a card with single perks.

In addition, the signup bonus on the card is weak. Most signup bonuses give you enough points for 2 free nights. This gives only one, no matter what you do. That is not nearly as lucrative as other offers.

Will Jeffsetter be getting one?

Probably not. I can spend $400 on better things. I have never stayed at a Ritz Carlton property, and frankly I’m not sure I belong there. I think committing to the Ritz Carlton is like Jerry Seinfeld committing to the an Orgy guy. Seems good at first, but there are a lot of hidden rules and expectations that make me uncomfortable.

Don’t go Chase-ing Waterfalls

Obligatory Chase themed pun, since they issue this card. I already have ~infinty cards with Chase. I don’t need to use my precious credit for this card.

Is it right for you? Absolutely, if you plan to make Ritz Carlton your new aspirational property and you don’t have lounge access currently. It’s also wrong for you if you are just getting started, don’t have clear travel plans, or you don’t plan on immediately taking advantage of 4-5 of the benefits upon signup.